The markets are an interesting psychological experiment. Everyday there’s a push and pull between sentiment and objective fact. The market is what we refer to as a “forward-looking” mechanism, meaning that it considers all the data we have today and anticipates / extrapolates what will happen. This is done by either bidding up (buying) the price of investments (stocks, bonds) or discounting the price (selling).

What’s problematic is that no one has all the information and certainly no one knows what’s going to happen. Price, every price, whether a product you buy or a stock we invest in is one part objective quantifiable cost and one part sentiment. A measure of sentiment needs to be included in our evaluation of what’s going to happen. Herein lies the problem. Sentiment may trump the observable facts in the market for a time, but reality will always correct sentiment. It’s just a matter of time.

In this commentary, we’ll discuss where sentiment has driven the market and whether that sentiment is justifiable or is an indication that we need to be guarded with our money.

As always, we tend to err on the side of being cautious as opposed to over exuberant. It’s a fault I’m happy to live with, especially when it comes to hard earned money.

Canada:

Every five years the BoC [Bank of Canada] renew its monetary policy framework. For decades the BoC has been tasked to provide price stability with an inflation target of 2% and a 1%-3% band. In its renewed mandate the bank of Canada kept its 2% inflation target and the 1%-3% inflation band, but its objective now includes a nod to reach and maintain full employment.

With Inflation hitting a 30-year high 4.8% in December and the unemployment rate falling to sub 6%, the Bank of Canada has already stopped growing its balance sheet (buying debt to support the credit market and government spending) and it’s expected to increase rates 3 or 4 times in 2022.

As it concerns fiscal policy [government spending], the outlook still looks rosy. In Q4 the federal government released its fiscal update. This update includes over $71 billion in new spending over seven years. The question now becomes who pays?

From the beginning of the pandemic the budget deficit has been financed mainly by the Bank of Canada through quantitative easing – the government creates bonds, those bonds are bought by the BoC. However, now that the BoC has stopped supporting government spending, interest rates will have to go up to encourage investors to buy newly issued bonds to finance spending or taxes will have to go up to pay for it. We are betting the government won’t cut spending.

In our view, spending will remain high and the BoC will continue to accommodate at any indication of a hiccup. Additionally, supply chain issues will have resolve to reduce inflation, current attempts by the BoC and government won’t have the affect desired. Lastly, although Omicron has added uncertainty to economic recovery, we expect the economy to continue its path to recovery, though with somewhat higher inflation than the last 10 years.

US:

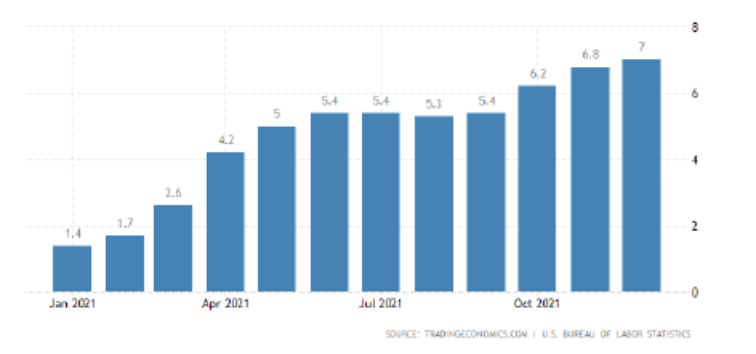

Inflation remained the concern for investors as 2021 came to an end. As the year-over-year reports arrived from the U.S. Bureau Labor of Statistics for October, November and December, the consensus language surrounding inflation moved from “transitory” to (copying a phrase from a popular 1970’s movie) “Houston, we have a problem”.

Astoundingly, the unadjusted Consumer Price Index [inflation] continued to climb, from 5.4% annualized at end of September, to 7% at year’s end!

Adding to concerns, annualized GDP for the period ending September 30 (the latest available since GDP lags by 3 months), registered at 4.9%, down significantly from 12.2% having been recorded at the end of July.

Taken together, it seems reasonable to conclude that persistent inflation is beginning to show its effects on the economic expansion that began in April of 2020, after the ultra-short 2-month recession brought on by the Covid 19 global pandemic

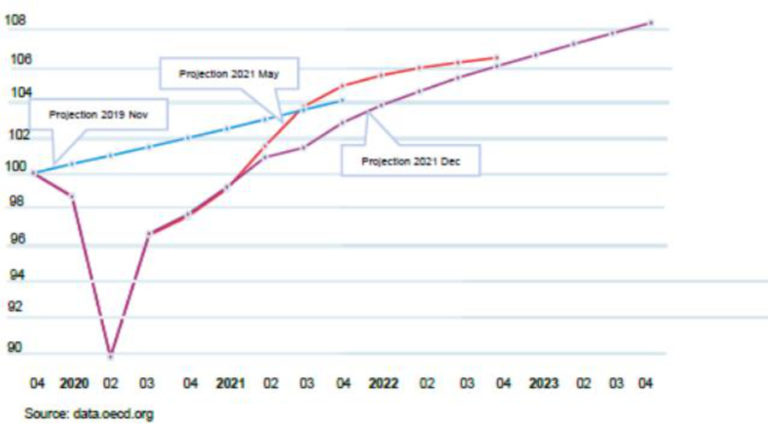

So what may lie ahead? Looking at the graphic below, as of December 2021, the OECD (Organisation for Economic Cooperation and Development) is forecasting Real U.S. GDP (adjusted for inflation) to grow steadily from a scale of around 103.8 to 105.5 by the middle of this year.

Note that this is lower than the forecast it made in May of 2021, when it predicted a bit above 106 for the economy by mid-2022. Looking at its full-year forecast for 2022 on a percentage basis, the OECD is predicting 3.55% real GDP growth for the U.S.

There has been a pattern with this expansion since early 2021 with actual numbers coming in below the OECD’s forecasts. Obviously, forecasts are difficult to make, but nevertheless it would seem the organization is grappling with what to make of inflation and the impact it is having on interest rate policy and economic growth.

Dizzying heights, the shoeshine Index.

It seems that sentiment continues to be rosy despite warning signs. Investors are suffering from a bad case of FOMO, (Fear Of Missing Out – watching everything go up and being compelled to buy) which will accentuate volatility. This tends to be a harbinger for tops in the market.

Charles Schwab coined the phrase “Generation Investor” to describe new DIY investors. Here are some of the characteristics of those investors:

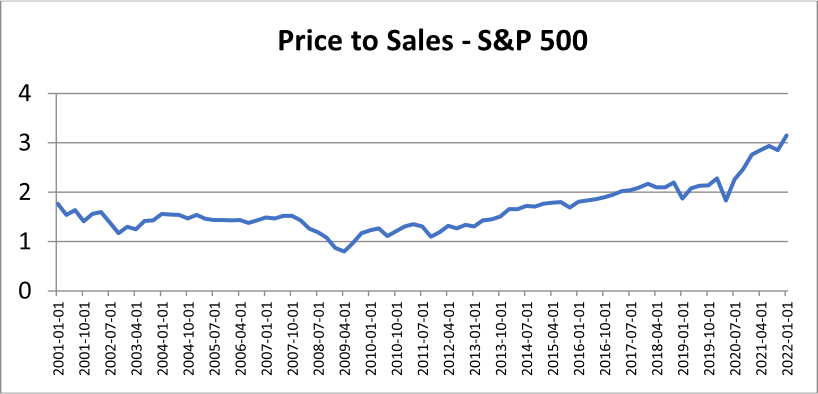

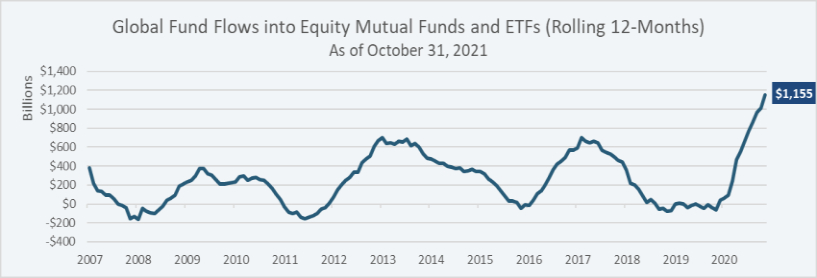

Whether looking at valuation or sentiment, as the following graphs depict, U.S. equity markets are, in a word, s-t-r-e-t-c-h-e-d and many investors seem to be convinced “it’s different this time.”

The price to sales ratio for the S&P 500 has far-exceeded its 20 year highs.

Source: multpl.com

Market Cap to GDP, known as the Buffett Indicator, is near 200%!

The forward P/E Ratio, though down from an extremely elevated level a year ago, remains factors above the historical average.

Source: Bloomberg Finance L.P.

And yet, investors are allocating record sums to equity mutual funds and ETFs. If history is a guide, investors’ optimism is likely unfounded when buying into the market at elevated valuation levels. Joe Kennedy once remarked that his shoe shine boy (right before the stock market crash in 1929) started to tell him which stocks to buy. He said at that point, he knew it was time to sell. From that point on, the “shoe shine index” was a concept thrown around to describe Fear Of Missing Out.

Source: Morningstar Direct

Thus far in 2022 fear is starting to creep into the markets with the realization that persistent inflation will lead to higher financing terms, not only with bond rates, but also in terms of the premium equity investors will demand for the added risks they take. From a strategy perspective, U.S. equity investors should look to raise cash on broad market rallies and deploy into selective areas that offer value pricing and reasonable upside potential.

Herein lies the problem. Everything seems rosy, portfolios are at the highest levels we’ve seen but indications are that we are at untenable levels, reality is going to come back and give everyone a rude awakening.

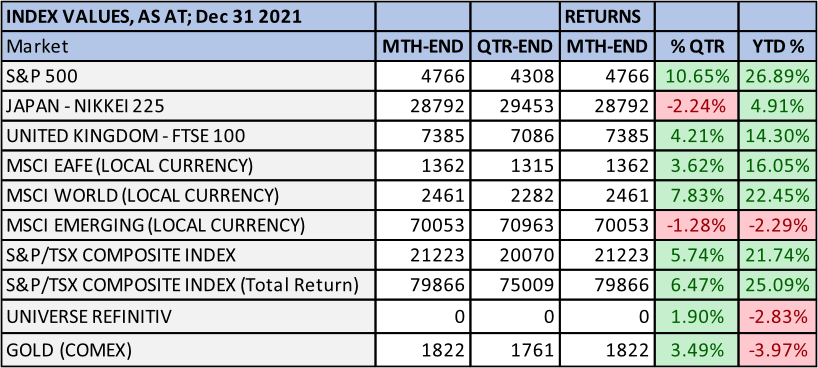

Stock markets around the world seemed to shrug off any implication that there was any indication of being over-valued, despite the above charts. The U.S. stock market, as measured by the S&P 500 Index, returned a staggering 10.66% for the 3 months ending December 31st and is up 26.89% for the year. Likewise, Canada followed suit with strong fourth quarter, adding 6.47%. For the year the Canadian market achieved double digit growth and returned 25%

Our portfolios reacted accordingly, having a great 2021. On a gross composite basis (aggregating all similar portfolios & before fees) all our portfolios produced double digit returns. Our Income Mandate produced a 13.37% return with the lowest risk amongst the four investment mandates. This was primarily due to its relative heavier weighting to high paying dividend equities like Bank of Montreal and Bank of Nova Scotia which returned 14.9% and 7.7% respectively.

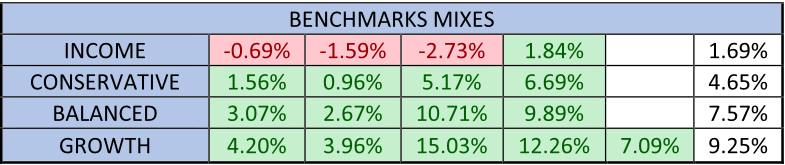

Over the quarter, all our portfolios added over 3.00% return. The only benchmark which outperformed was the growth benchmark (comprised of 30% bonds – XSB iShares Dex Short Term Index ETF and 70% TSX – XIC iShares SP/TSX Composite Index ETF.

We also added positions to the portfolio including Wheaton Precious Metals, Leon’s Furniture, Loblaws, Maple Leaf Foods, Algoma Central Corp and Airboss of America. All of which, except for Algoma Central Corp ended the year higher.

We stand on the edge of a tipping point in the markets, similar to that of Dec 2019. At that time we made a decision to raise cash and become nimble. We find ourselves in a similar situation today. We will be closely watching the markets through the course of January and February for an indication of what the rest of the year has in store and if necessary we won’t hesitate to transition the portfolios into a more defensive posture.

Should you have any questions related to our services, your account, or this commentary, please do not hesitate to contact your Portfolio Managers Mark Taucar (905)-715-2260 or John Lombard (905)-484-3482.

This communication is intended for information purposes only and does not constitute an offer to sell or a solicitation to buy securities. No securities regulatory authority or regulator has reviewed or assessed the merits of the information provided. This communication is not intended to assist you in making any investment decision regarding the purchase of securities. Rather, Accilent Capital has prepared relevant documents for delivery to prospective investors that describe certain terms, conditions and risks of investment and certain rights that you may have. You should review all relevant documents with your professional adviser(s) before making any investment decision.

This report may have forward looking statements. Forward looking statements are not guarantees of future performance as actual events.

While every effort has been made to ensure the correctness of the tables, graphs – all data. Accilent Capital does not warrant the correctness, completeness or accuracy of financial data in this publication.